unrealized capital gains tax yellen

The impacted assets include stocks bonds real estate and art. Be sure to like and subscribe and hit the bell button for channel alertsSend Fan Mail with USPS ToCOMMANDER VLOGSPO BOX 643EAST OLYMPIA WA 98540Send Fan.

Democrats Unveil Plan To Tax Unrealized Capital Gains

The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US.

. Janet Yellen is proposing a tax on unrealized capital gains. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. With odds of a split US.

Not this this will ever happen because the majority of the wealthys net worth is in unrealized gains. Government coffers during a virtual conference hosted by The New York Times. Probably the biggest tax loophole.

The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. NEW US. Lawmakers are considering taxing unrealized capital gains.

Speaking on CNNs State of the Union on. 10 rows A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the.

Yellen had first proposed the tax on unrealised capital gains in. A California resident would see the following taxes. It looks like Janet Yellen would like to tax unrealized capital gains.

Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet could. It is the theoretical profit existent on paper. The Biden administration is looking to raise its tax revenue to fund a 35 trillion spending plan over ten years.

Congress rising Treasury Secretary Janet Yellen warned that lawmakers failure to raise the statutory limit on US. Speaking on CNNs State of the Union on. Treasury Secretary Yellen proposes a tax on unrealized capital gains to finance Bidens Build Back Better plans.

But taxing unrealized gains is closing a tax loophole. The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US.

The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. Not exactly sure how that would work especially if the next year the stock price drops below what you paid. For example perhaps you purchased a house at 300000 and sold it for 350000.

National Investment Income Tax 38. Treasury Secretary nominee Janet Yellen reportedly said she would consider taxing unrealized capital gains but billionaire investor Howard Marks said its not a practical. President Biden needs to raise money for his administrations goals and United States Secretary of the Treasury Janet Yellen has an idea.

Track Clients Potential Tax Liability with Tax Evaluator. Federal long term capital gain rate 396 BidenYellen proposal v 20 today. If you still owned the house when it was valued at.

Debt posed a huge threat to. This tax would tax stocks. Capital gains taxes are taxes that investors pay on profits from the sale of stocks or other investments.

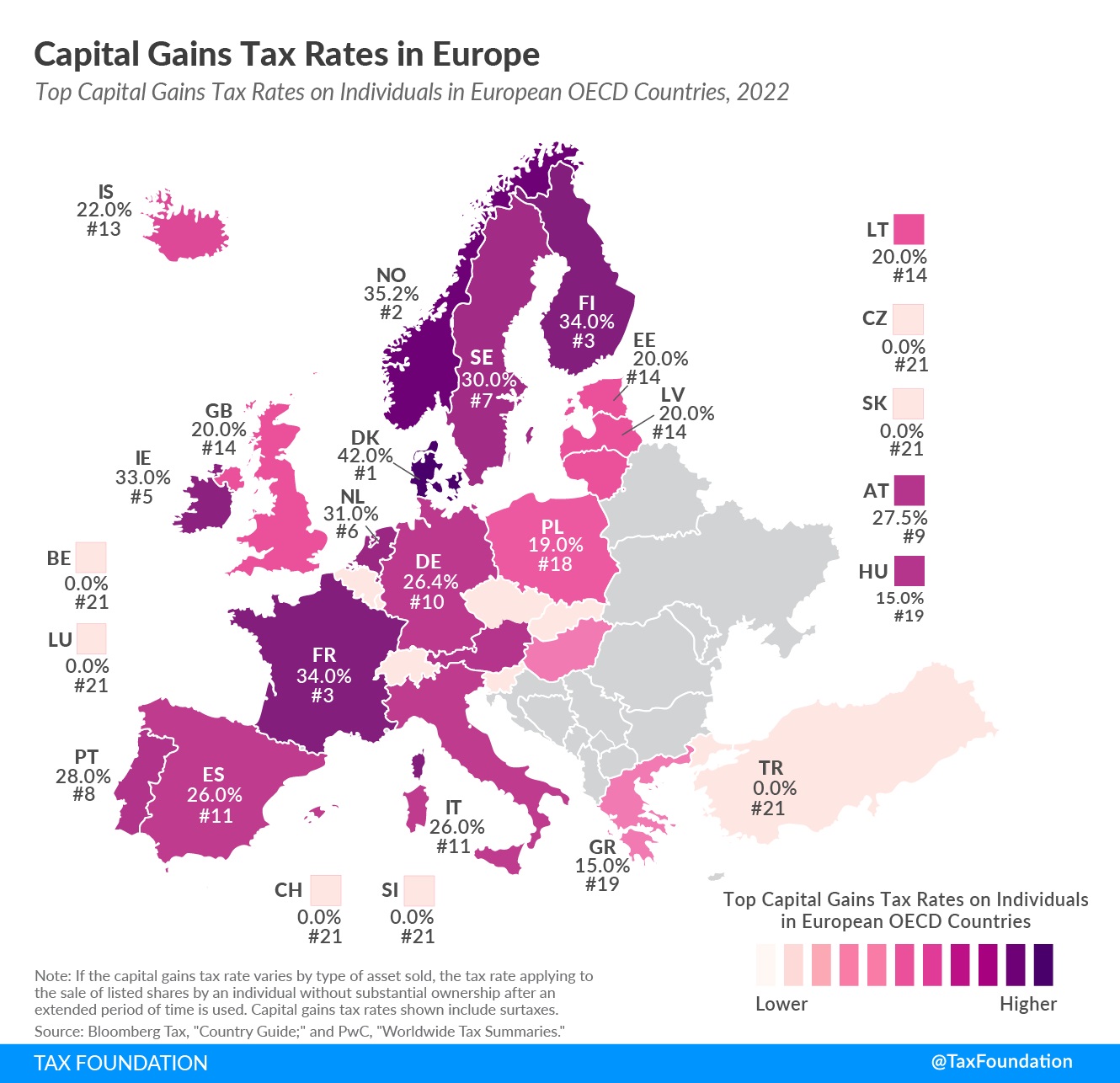

Capital Gains Tax International Liberty

Why Congress Shouldn T Rush To Enact Poorly Conceived New Taxes To Fund Spending Spree The Heritage Foundation

Yellen Describes How Proposed Billionaire Tax Would Work Barron S

Proposed Tax On Billionaires Raises Question What S Income The New York Times

No U S Won T Tax Your Unrealized Capital Gains Alexandria

The Trouble With Unrealized Capital Gains Taxes The Spectator World

Biden Budget Biden Tax Increases Details Analysis

Dems Plan Billionaires Unrealized Gains Tax To Help Fund 2t Bill

Janet Yellen On Jobs Debt Taxes Climate And Cryptocurrency The New York Times

Democrats Terrible Idea Taxing Profits That Don T Exist

With Corporate Tax Off Table U S Democrats Turn To Billionaires To Fund Spending Bill Reuters

Being Libertarian Janet Yellen Kv Facebook

Democrats Appear To Back Down From Unrealized Capital Gains Tax The Daily Wire

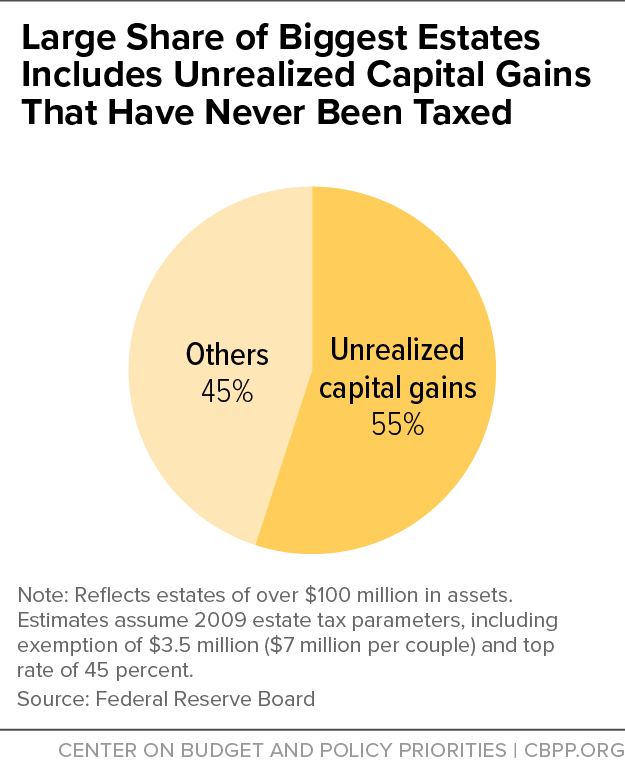

Large Share Of Biggest Estates Includes Unrealized Capital Gains That Have Never Been Taxed Center On Budget And Policy Priorities

Unrealized Capital Gains Tax Wrongheaded Proposal National Review

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

Idea Of Taxing Unrealized Gains Resurfaces As Money Printing Intensifies

Do Democrat S Approve Of Biden S Tax Plan To Eliminate The Stepped Up Basis Capital Gains Tax In How It Affects Small Family Farms Quora

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis